|

2008-03-10 12:35:35

GENERAL ECONOMIC SITUATION

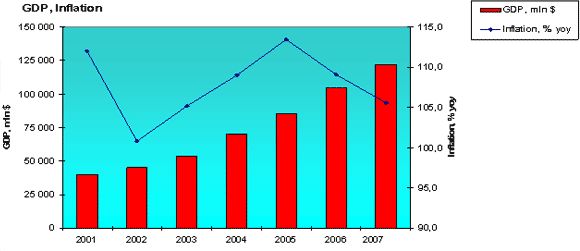

Ukrainian economic performance can be characterized by the next chart.

Source: ICPS, State Statistics Committee. E estimate, F forecast

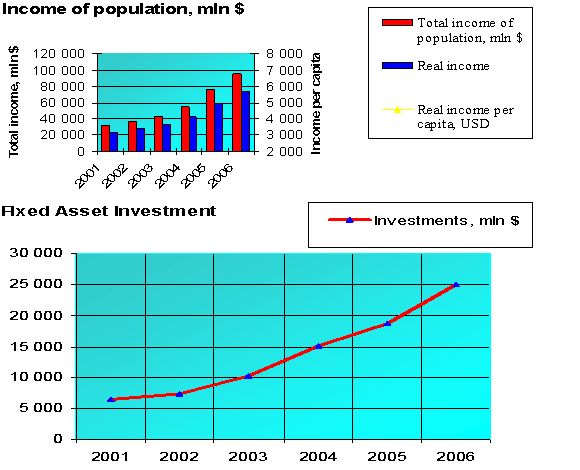

All the main economic indicators are ameliorating steadily, e.g. in 2005 GDP growth was 2.6 % and in the 2006 its growth amounted 7%. Scheduled entry into the WTO and the EU in the nearest future, stabilization of the political situation, and predicted growth of real income of population will altogether lead to constant GDP growth.

The inflation level fluctuations were not substantial and the level itself was often lower than it was predicted. But the tangible growth of the public services price and agricultural products price caused the CPI leap until 11,6 % in the end of 2006.

The trade balance of Ukraine in 2007 will remain negative, but the economic stability will be backed by large amounts of direct foreign investments and considerable size of gold and foreign currency reserves.

Other economic indicators are growing up rapidly as well, that is why the economic growth of Ukraine has undoubtedly positive prospects.

Taking into account strong performance of Ukrainian economy despite of gas price hike in 2006, further stable growth of GDP in 2007 is expected. Experts say GDP growth rate will reach 5,5,%. Faster economic growth will be restrained by the less socially oriented government's spending, higher energy costs and the effect it has on disposable incomes of the population.

GENERAL INFORMATION ABOUT UKRAINIAN REAL ESTATE MARKET

Legal overview

The principal laws governing real estate market of Ukraine are as follows:

The fundamental law - The Constitution of Ukraine

The Law on Securities and Stock Market

The Law on Economic Competition Support

The Law on Institutes of Joint Investments

The Law on Investing

The Law on Financial and Credit System and Property Operation and Management

The Law on Government Control of Stock Market

The Land Code of Ukraine

The Law on State Amount of Housing Privatization

The Law on Local Government

The Civil Code of Ukraine

The Law on Construction Activities and its Planning

The Law on Architectural Activities

The Law on Land Lease

The Law on Ownership

The Law on Prices and Pricing

The Law on Corporate and Institutional Liability for Municipal Engineering

TAX OVERVIEW

Overall there are around 40 taxes and duties envisaged under Ukrainian tax system. The most material affecting the majority of the corporate taxpayers are Corporate Profit Tax (CPT), Value Added Tax (VAT), Personal Income Tax (PIT) and some other social charges and contributions.

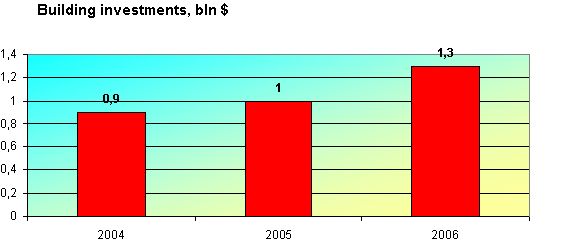

Real estate investments during last five years

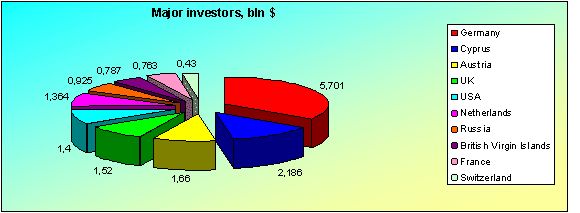

According to experts, Ukrainian real estate market, despite its high risks and bureaucracy attracts foreign investors powerfully due to its high profitability.

Professionals of the real estate market can not say surely which market sector to prefer. They say it all depends on the specific purpose, plans and investment portfolio.

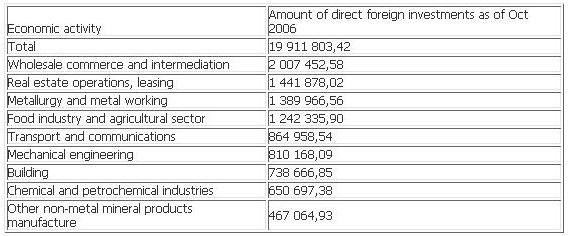

Year by year the amount of investments Ukrainian real estate gets from the foreign investors increases significantly. Foreign investments amounted almost $ 3 800 billion in 2006, that is thrice bigger than in 2005. Financial activities got the largest amount of foreign money - about $ 993 million, while real estate market got $ 385 million.

Direct foreign investments according to different market sectors, thousand $

Ukrainian realty market is undoubtedly attractive for foreign investors. Many of them have already shown their profound interest in such a market entry, but the political instability of the last two years has ceased this positive trend. According to the latest researches, the market revives again. That can be illustrated by growing number of Russian investors who entered the market this year. But the high rate of return attracts foreign investors as well.

The main indicators of building sector.

The main factors that suppress investors' fast entry are difficulties in licensing and poor legislative basis. Foreign investors try to eliminate the possible risks by buying ready-built property. Due to high capitalization rates (about 9-16 % in Ukraine and only 6-8% in other Eastern European countries), Ukrainian real estate market can be really lucrative.

Experts also remark that the investment climate will be profitable and attractive until the profitability drops to other Western European countries' level. This will not happen until 2009-2010, professionals reassure.

OFFICE PREMISES

Growing demand is based on a stable economic situation. As local developers gain experience and international developers step in, more professional office projects will appear meeting growing demands of the market.

Structure of take-up by nationality in 2006 was as follows:

Class 'A' business centres typically do not have vacant offices, which is due to high demand and low supply. Class 'B' business centres are very popular as well - about 98-100 % of their sites are full. Kyiv needs about 2 152,78 square feet of office premises every year.

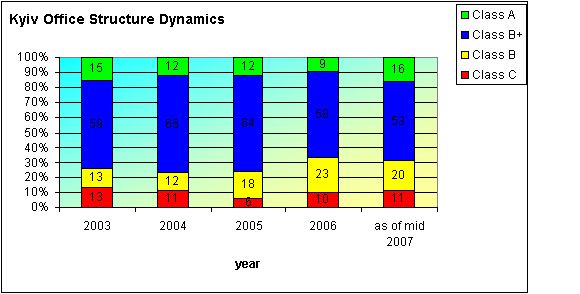

Structure of the office premises according to their classes.

The most popular are business centres and office premises of A class. They are 100 % full, which is based on such premises deficit. The main tenants of office premises in class A business centres are multinational companies, representatives of foreign companies or large domestic corporations : IMA Group, TAC, Panasonic, Sony, Samsung, WBB, SAP AG, Da Vinci, Nafta-Service Ukr.Marsh, Philip Morris, Intel.

Class B business centres are popular too, the level of fullness there is about 97-100 %. In such premises around 60 % of the sites are leased by western companies, another 40 % are divided between Ukrainian and Russian companies. The following companies are the tenants of offices in class B business centres: Mary Kay, Adidas, Renault, Robert Bosch, Yamanochi, BBC, Visa, PepsiCo, Whirlpool, Nokia, Interpipe, Regus, Ratiopharm, Ernst & Young, Altima, USA and UK embassies.

Class C business centres are 90-95 % full, and their tenants are such companies as: Burda-Ukraine, Kodak, Nagel, Polfa, Polfarma, Thomson, Furnel, Sanitec Kolo, Ukrturinvest, Naftogaz of Ukraine, Kyivstar, different advertising agencies, magazines' and newspapers editorial offices.

The most popular sites in class A business centres are those of area less than 100 square metres and bigger ones - 400-600 square metres. Due to companies' diversification, office premises of big size - about 800-1 500 square metres are in deficit as well.

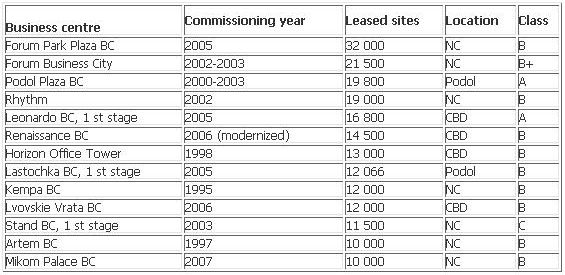

The main business centres of Kyiv are:

CBD- Central Business District,

NC - Non-CBD.

During six months of 2006 office premises price has grown up by 20-50% and reached: in CBD - 2 000-3 000 $ per sq metre, 1 500-2 000 $ per sq metre business centres located near to CBD, and 1 000-1 500 $ per sq metre in business centres located outside the CBD.

Regional information:

According to 2006 statistics there were about 48 BC which could be rated as class B business centres. Their total area amounted 200 000 sq metres.

Current deficit and price growth caused the market to flourish and developers to advance their business. In 2005 there were only 60 000 sq metres of office premises built, but in 2006 total area reached 77 000 sq metres. Moreover, the total area of an average BC in 2006 has grown up by 28% and amounted 4 800 sq metres.

During year 2006 the rental rates for office premises rose considerably as to the end of 2005. Rental rates have grown up by 30-40 %, while the selling prices rose only by 25-35%. Office premises price achieve its maximum in the central business districts (CBD). There, the leasing price is about 40-50 $ per sq metre, and selling price is 3 000-4 000 $ per sq metre. In other cities and regional centres price are a bit lower - 30 and 2 000 correspondingly. Current deficit of office premises is illustrated by Donetsk prices, that are higher than in other regions. In Dnepropetrovsk, for example, these indicators, due to higher supply, are much lower.

Conclusions:

- Demand still exceeds supply, even though the level of supply is growing year by year

- Rental rates continue their constant growth

- Free sites in class A business centres are only 1,5-2 % from its total area

- 60 % of all the business centres are rated as B class, and only 9% of the class A.

- Total office premises area reached 570 000 sq metres, which is still not enough for developing businesses.

- The main trends of the last year were: high demand on office premises situated in non-central business districts, and growing demand for quality premises. Leasing of offices is currently more popular than its purchase. This is a sequence of high selling prices and low supply of quality office premises for sale.

- Many market participants prefer leasing to sale, because of instability in political and economical spheres.

- Well-developed infrastructure of the business centre, made according to market researches and potential tenants' surveys will lead a business centre to prosperity

- Currently there is a trend of building office premises within a large business centre which include food courts, fitness centres, and even shopping area.

Prospects:

- Demand for quality professional office premises will remain high in 2007 and the tendency of rental rates growth will consequently be at level of 10-15 % per annum. Only business centres that will not be able to compete with its rivalries will show negative tendency (not more than 5-10 %) and may even lose their high class.

- Saturation of the market is expected in few years when another 14 business centres will be ready for their star-ups. But a continued economic growth in Ukraine and prospective amount of the direct foreign investments will raise the demand again.

Main office premises and their commissioning dates.

- Competition between sellers and lessors will cause office premises quality's growth.

- The overwhelming disparity between demand and supply will cause new office premises to be fully absorbed by the market before commissioning. It means that 'lessor's market' will be prevailing during at least two following years.

RETAIL PREMISES

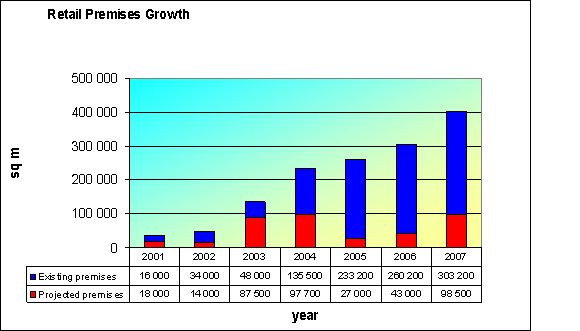

Retail premises are one of the most attractive fields of investments because of the growing buying power of the population (20 % per annum) and retail premises quality's growth.

There are already some international retailers that are very active - METRO Cash & Carry, Billa. More and more foreign retailers are planning to enter Ukrainian market in the nearest future: Auchan, IKEA, OBI and Praktiker.

Demand of the population is still higher than the supply even though there are many retailing projects in Kyiv.

The most popular retail premises are situated in the CBD. Many industrial areas are being restructured into retail parks with a well-developed infrastructure. Cheap land and convenient location are the main factors which raise demand. All the types of retail premises are popular - from small (40-150 sq m) to large ones (600-1 000 sq m) that are usually used as supermarkets. Currently developers are competing with each other for tenants, as market lacks in professional operators.

Average rental rate fluctuates between $ 30 and $ 60 per month. The biggest rates for boutiques - $ 70-80 per sq m - are paid in the shopping centres situated in the central part of city. The highest rate in the product category is paid by accessories and presents sellers ( $ 120-200 per sq m).

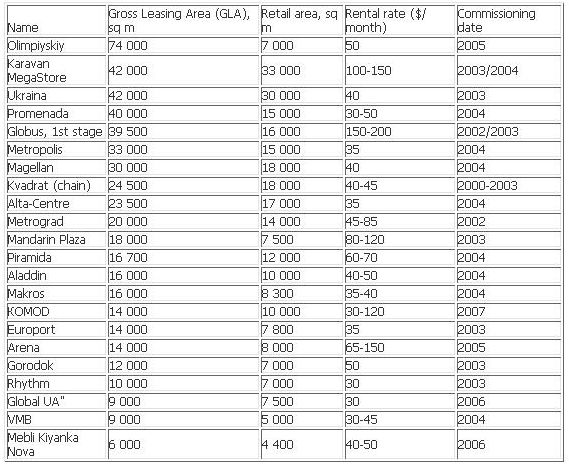

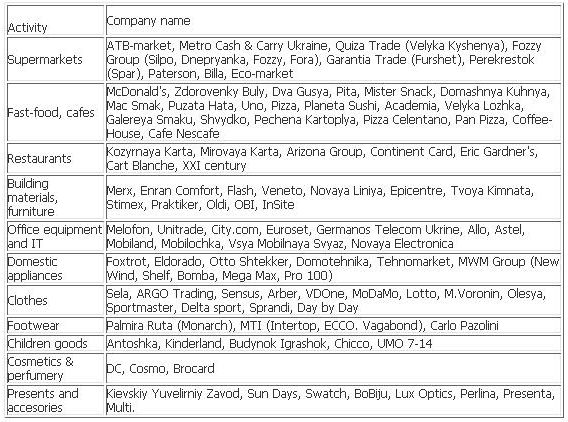

Major shopping centres of Kyiv and their rental rates.

Pricing depends on shopping centre's location. Also rental rates differ according to the quality, condition and the size of the premise. Contracts of sale assemble 10 % of total market operations.

Large companies that are anchor tenants.

Regional information:

In 2006 two large shopping centres were commissioned in Dnepropetrovsk and Donetsk - 'Most' and 'Donetsk City'. These were the first large shopping centres opened outside Kyiv.

Karavan opened the hypermarket as the first phase of its regional shopping centre in Kharkiv (total rentable area of 56 000 sq m) in December 2006 with the second stage due to opening early 2007.

Tavria V, Odessa's largest retailer is opening a 5-level shopping centre Pobeda (19 000 sq m of GLA) in February 2007. A number of other large shopping centres that are currently on the pre-design stage will be delivered in 2008-2009.

In Lviv, first large shopping centres will not open until 2008 when two large rival projects get accomplished. The schemes, developed by the Ukrainian (Intermarket) and Italian (King Cross) developers and bearing the same name - Leopolis will offer the compound of above 95 000 sq m of lettable premises for professional retailers to open their first stores in the city. The projects are presently pre-leasing.

Overall, by 2010 the total stock in each of the five largest cities of Ukraine is to exceed the benchmark of 100 000 sq m of GLA, raising supply of professional retail space per 1 000 of population in each of the city to above 100 sq m.

A clear trend towards design of large and quality modern shopping centres can be observed in all large Ukrainian cities. Second-tier cities (under 500 000 people) are picking up as first large projects are getting planned. However, limited interest of professional retailers to these cities for the next two or three years makes large developments impossible without bringing into the project no-name local tenants, which lowers the investment value of such schemes.

Conclusion:

- Demand for retail premises exceeds supply greatly

- Rental rates depending on the location and quality of the premises vary from $ 30 to $ 200 per sq m.

- Vacancy rate is about 3%

- Number of foreign developers seeking for land areas in Kyiv grows up constantly

- In order to become successful a shopping centre should be:

- constructed overhead

- should have shopping or entertainment orientation. Innovative for Ukrainian market formats such as 'mega mall' or 'master park' can be really lucrative.

- Premises in the commercial or trade passages are very popular because of their location. There are more than 10 trade passages, best of which are Kreschatik, Maidan Nezalezhnosti, Bessarabka, Velyka Vasylkivska str., T.Shevchenko blvd., Pobedy Ave., and Petrovka. Vacancy rate here is lower than 1-2%.

Prospects

Major shopping centres projected to be delivered in 2007-2010

- Quality of shopping centres' conception will improve

- Size of the shopping centres will increase

- Retail premises will get more investments

- Rental rates will be growing

- Developers will draw their attention to the territories outside central part of the cities

- High level of competition will raise the quality of shopping centres considerably

- Entertainment sector will get more sites in the shopping centres

- The professional retailers number will grow up from current rate of 65 % to 80-85 %.

The growing supply in Kyiv will serve as an anchor that will bring to Ukraine a number of new tenants from abroad, which in turn will increase the demand in the markets as the new-comers start building their local retail chains. New leasing opportunities will be also appreciated by retailers who are already in the market and are willing to expand their operation not only in the regions of Ukraine, but also in the capital

HOTEL MARKET

According to the official statistics, presently there are 118 hotels (about 8, 500 rooms for 15, 600 people). 23 hotels are 'big' which means they have more than 100 rooms.

But most of Kyiv hotels were built 30 or 40 years ago and do not correspond to the world standards. Quality hotel services arrived in Kyiv only in 2000 and yet did not become widely-spread.

Kyiv hotels are able to welcome about 1 million of visitors per annum. But this number is not enough, because number of people visiting Kyiv grows up by 14-15% per annum. Most of people coming to Kyiv are newcomers from other cities of Ukraine but one third of visitors are foreigners.

Certificates of conformance were granted only to 51 Kyiv hotels:

- Only one hotel ('Premier Palace') has got 5*

- There are 6 hotels rated as 4*

- 17 hotels got 3* status

- 2* were given to 20 hotels

- 7 hotels were nominated 1* status

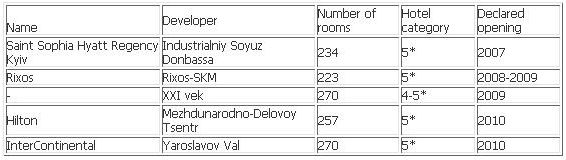

Four and five stars hotels of Kyiv.

The best hotels of Kyiv are, of course, situated in the central part of the city. This trend is caused by the fact that most of such hotel visitors are businessmen and foreign pop-stars. Both of them like to stay in 4-5 * hotels, which are situated near offices, business centres and main tourist attractions.

Kyiv hotels are currently only 55% full. And it is the lowest vacancy rate among all Ukrainian hotels. 4 and 5* hotels are a bit more popular - 70%. That can be explained by their location, services range and deficit.

Regional information:

Presently only three hotels of Ukraine posses 5* status - 'Premier Palace' in Kyiv, 'Donbass Palace' in Donetsk and 'Rixos' in Truskavets. Only 'Rixos' and 'Donbass Palace' are members of international hotel organizations. 'Donbass Palace' even joined The Leading Hotels of the World Association (LHW) that unites 425 hotels in 80 countries and which is headquartered in New York.

There is only one Ukrainian hotels chain - 'Premier'. 6 hotels all over Ukraine are members of 'Premier' - 'Premier Palace', 'Oreanda' (Yalta), 'Dnister' (Lvov), 'Star' (Mukachevo), 'Londonskaya' (Odessa), and 'Cosmopolit' (Kharkov).

Cocnlusions:

- Ukrainian hotels' profits grown by one third as compared to the previous year

- All Ukrainian 5* hotels are full all over the year

- During the last two years the profitability of quality hotel has grown due to the growth of demand

- Kyiv hotels are the most prospective ones, but other cities with the population over one million people and Ukrainian recreational zones such as Crimea and Carpathian mountains can be lucrative as well.

- There is only one hotel, managed by the international hotel operator - 'Radisson SAS' on Yaroslavov Val str. Unfortunately, the cooperation of Ukrainian hotels and such international brands as Accor, Hilton, InterContinental, Marriott and Kempinski is still up in the air.

- Rooms in Ukrainian hotels, especially in Kyiv are more expensive than in their European counterparts.

Prospects:

Hotels planned for delivery in 2007-2010 (Kyiv)

- Demand for quality hotel services will exceed supply for at least 5-7 years

- European integration process will take place and bring positive trends into Ukrainian hotel market

- Investment climate will be improving steadily. Consequently business activities will be growing up as well

- Number of foreigners visiting Ukraine as tourists will increase. There will also be a growing number of people visiting Ukraine and its capital for business

- EURO-2012 will be a good incentive for hotels' development and will also attract foreign investments

RESIDENTIAL REAL ESTATE

About 1, 200 mln sq m of residential property were commissioned in Kyiv in 2006 and 9 000 flats were offered for sale. But demand exceeds supply. The commission of residential real estate doubled in the second half-year of 2007 and reached 383 000 sq m. But market slackness caused by high prices and political instability will not last long. Incomes of Ukrainians continue to grow, and credits become cheaper. That is to say that Ukrainians will continue to buy residential estate, even if it is overpriced. Currently, 200 houses are being built.

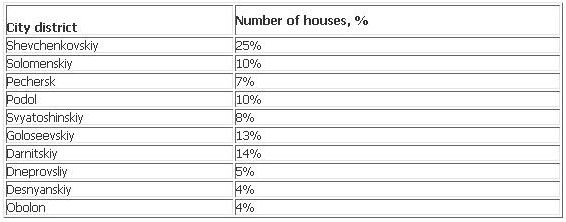

On the table below you can see approximate percentage of buildings according to city districts.

We can not fail to mention active development of left bank of the Dnieper. Moreover, these objects are often of the 'mixed-use' type, which presupposes that within one large building its inhabitants will be able to find supermarkets, entertainment centres, service and office centres. The following premises are the examples of mixed-use real estate: Mega City, Dneprovskaya pristan, 31-33 Pravdy Ave., 3 Sribnokilskaya str., and some others.

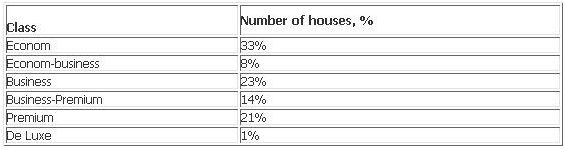

According to Ukrainian Building Association classification, there are 5 classes of residential real estate: social real estate, econom-class, business class, premium and de luxe classes respectively. If we try to classify the residential premises in Kyiv which are currently being built we will get the following data:

Percentage of A1 class (premium and de luxe class) residential real estate is a bit more than 20 %. These are the houses in the central part of the city with a well-developed infrastructure, big car park and sophisticated architecture. Price of a square metre there varies from $ 3 to 15 000. Given Ukrainian 'de luxe' class do not correspond with European and world standards, developers have to make up a special appeal to attract customers. For example, if you buy a flat in Delfin residential community you will get a free design for your flat. Alpiyskiy residential community will give you free parking places for your cars. Triumph has the most interesting bonuses - your flat will be 'smart' which is innovative for Ukraine.

The main developers are: Kievgorstroy, Zhilyeinveststroy-UKB, Ukoinveststroy, Granit, and IBK-Stolitsa. Mirax, TMM and XXI vek work in the field of premium and de luxe real estate classes.

Stoppage of 111 buildings two month ago reveals a negative trend of Ukrainian building industry - developers start buildings without needed permissions. Moreover, residential real estate is almost never commissioned as scheduled. We can still see unfinished projects, which were to be done by 2005 or 2006.

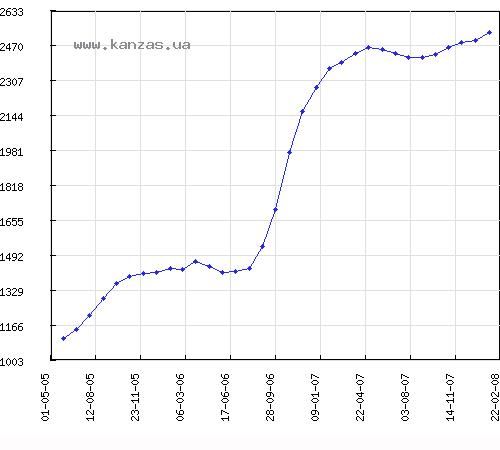

If we compare residential property prices with such of August 2006 we will see that prices grown up by 40 %. If to compare current data with January 1st 2007 - the prices raised by 12,5 %.

It should also be mentioned that the statistical uncertainty in the data above can be substantial, because the developers do not always give adequate information.

According to the State Statistics Committee, during first seven month of 2007 Kyiv builders used 25% more funds than the last year. Still it does not mean they built 25 % more property, as the deficit is still noticeable.

Regional information:

Top 5 Ukrainian cities with the highest residential property prices are: Kyiv. Odessa, Dnepropetrovsk, Sebastopol and Kharkov.

Prices in Kyiv are 2, 2 times higher than in Kharkov.

Prices in the cities listed in the table below from 6th to 12th do not differ much (Donetsk, Simferopol, Lvov, Nikolaev, Uzhgorod, Chernovcy, Khmelnickiy).

Difference in price between Simferopol (7th position) and Vinnitsa (12th position) is 7 %.

The lowest residential real estate prices are in Sumy (760$/sq m), Kherson (750$/sq m) and Kirovograd (645$/sq m).

We can not fail to mention that only in the two cities - Kyiv and Odessa - residential property price exceeds average indexes greatly.

In other cities prices are lower than the average index.

Higher prices in Odessa traditionally are due to its geographical location, and due to the fact that Odessa is a seaport with developed industry and infrastructure. Moreover, Odessa is a well-known health resort.

That is why Odessa is on the second position in our rating.

Dnepropetrovsk is on the third position because it does not only have a developed industrial sphere but also has a high level of cash flows. Residential real estate market in September 2007

Deep analysis of facts and trends allows us to infer that Kyiv residential real estate market is reviving and shows positive dynamics.

Because the real estate market is characterized by a high level of inertia, prices will not change substantially.

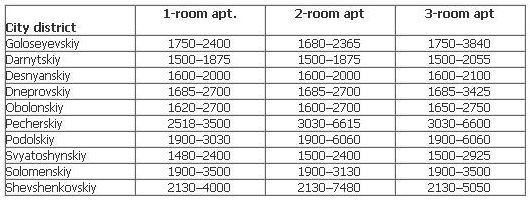

Average prices for flats under construction (primary market) in Kiev as of mid-2007, $/1 m2

Average price growth on primary market in other Ukrainian cities in 2007 vs 2006

Price development on the secondary market in Kiev, $/sq. m : 2005 - 2008

INDUSTRIAL PREMISES

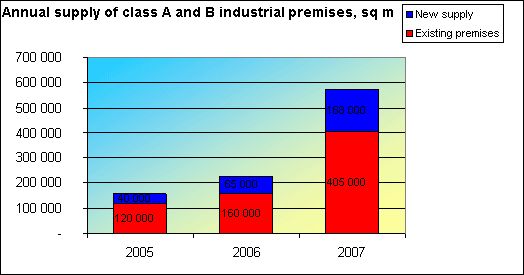

Warehouse premises market will grow greatly in the nearest future. Present growth of business activity and retailing market development presupposes high demand for warehouse premises. Plan of new warehouses building adopted by city authorities will also incite logistics development.

During the next year industrial premises market is not predicted to rise, as most projects are still unfinished. But in the next two or three years international developers will enter Ukrainian market. In such a situation rental rates will raise.

Current year will be characterized by growing demand for professional warehouses and descending interest to warehouses of poor quality. Customer becomes more and more exacting, and the ideal logistics object should conform to sanitary standards, should have all the necessary services and equipment.

In 2006 average price per sq metre in a high-quality logistic complex outside Kyiv was about $ 8-10 per month, while the price for the same service in-town amounted to $ 15 per month. Full occupancy cost also includes operating expenses (typically between $ 1,5 and 2,5 per sq m) and VAT of 20%.

Low-quality warehouses, mainly refurbished manufacturing premises, leased significantly cheaper at $ 5-7 per sq m per month, net of VAT and operating expenses.

Despite all the possible risks Ukrainian and Kyiv markets are regarded as one of the most prospective ones of the Western Europe. Experts predict the market to flourish after the final stabilization of Ukrainian economics.

Regional information:

Warehouses market is poorly developed. Odessa and its region are the most attractive regions in terms of its: possibility of dealings between the countries of Central, Western and Northern Europe with the countries of the Central Asia, Palestine, Arabia and Northern Africa; possibility to connect Northern and Central Europe with Balkan Peninsula and Middle East via the Danube; Odessa region also has transport communications of great importance, the highways connect Russia and Central Asia with Turkey and the countries of Balkan region; possibility to use region as terminal station between Europe, Asia and Africa.

We can also conclude that European integration of Ukraine will be impossible without Odessa region and its facilities. But warehouses of the region need improvement and investments. Despite the fact that such seaports as Ilyichevsk, Odessa and Yuzhniy has high freight turnover they still do not have any logistic complexes. Warehouses are represented by construction of class C with minimal rental rate of $ 2,5 per sq m per month. Class B warehouses are in minority of 0,4% with rental rate starting from $ 5-6 per sq m per month.

In the nearest future logistic complexes of high quality will surely appear because some international logistic companies have already shown their profound interest in the region as a junction point between East and West. On the other hand, nearest junction points of these companies are situated in Poland and Hungary, which is inconvenient.

Currently, the largest part of all Ukrainian warehouses is situated near Kyiv.

Conclusions:

- Only 15% (about 150 000 sq m) of the warehouses are of good quality. Demand for such premises is only 15-20% satisfied.

- Logistic complexes with total area from 1500 to 4000 sq m and bigger than 10 000 sq m are of high deficit.

- Demand for quality warehouse premises exceeds supply greatly.

- Modern warehouse should also provide logistic services.

- Competition is underdeveloped; there are not more than 20 companies on this market. Logistic companies and traders prevail over developers.

- Rental rates in Kyiv and region in 2007 vary from $ 3 to 6 per sq m per month - for warehouses of poor quality; to $ 7-12 per sq m per month in professional warehouses or even $ 30 for the so-called 'eurowarehouse' or refrigerated warehouse. Selling prices began from $ 200-400 per sq m and grown up to $ 450-530 per sq m (in warehouses with convenient location). In the central part of city selling price amounted $ 650 per sq m.

- Rental rates growth in 2006 was about 15-20%.

- Rent-sell ratio was 70 to 30% correspondingly. Sale of warehouses, without any premises on its territories amounted only 5% from total sales. Typically, warehouses which were situated on other enterprise's territory were sold or warehouses were for sale as parts of different businesses.

Prospectives:

- Class A logistic complexes construction will be the most profitable business. As a result of The Capital Development Plan adopted by Kyiv authorities, new logistic complexes in the nearest suburbs will appear.

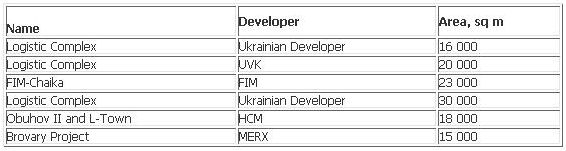

Major projects scheduled for 2007-2008

- The growth of rent popularity will not be lower than 10-15%. Selling price will grow by 10-20% as well, which will be caused by constant land price increase.

- The main factors that will influence market's development will be as follows: the macroeconomic state of Ukraine, investment risks elimination, domestic and foreign retail chains' development. Retail market development will increase demand for high-quality warehouses.

- Demand for low-quality warehouses will drop in 2007 and the next years.

- There will appear international developers with new projects towards high-quality logistic complexes.

- The substantial increase of warehouses market will be noticeable in 2007-2008. But, according to other Central European countries' experience, the developer should pay great attention to the cooperation with prospective clients. This can be done by implementation of 'built-to-suit' policy.

PROSPECTS AND OPPORTUNITIES

The most attractive sectors of Ukrainian real estate market

Residential property will remain the most profitable sector for investments. It has the highest and the fastest return on investment (ROI).

Investors, who prefer stable market sectors to risky ones, may need to choose more transparent fields for their investments.

Last year was characterized by scandals between developers who were not able to meet their commitments to the investors ('Elita Centre' scandal, etc.), and growth of building materials prices accompanied by general market non-transparency.

Real estate market always adhere to the same tendency: the development of residential real estate causes office premises to appear, and then the latter impels the hotels to develop and so on. Ukraine follows that scheme as well.

According to the market operators' evaluations, it is residential realty that will be the most prospective, because demand to supply ratio is stable. But the prices are a bit more difficult to foresee: some experts say that they will continue to grow up while others predict they will remain unchanged. But most of professionals agree that prices will not drop in the nearest future, and that is why residential realty is so attractive to investors.

When it comes to office premises we should point out that the level of profitability of domestic commercial objects is about 12-15 % per annum, while in Poland and Czech Republic these indicators are about 6-9 %. Payback period in Ukraine is about 3-5 years, while in Europe it takes up to 12-15 years, which is undoubtedly a great plus for the companies that are constructing office premises in Ukraine.

Foreign companies may receive huge profits by investing in office realty, but these profits will be a bit 'slower' than in residential realty. Moreover, the owner may sell his/her business centre in a few years and get a great profit.

Business is flourishing that is why investors and developers tend to invest more in office premises. Experts also predict that a deficit of high-quality offices and high rental rates caused by the abovementioned will make the office premises market popular among investors.

Foreign companies typically buy commissioned office centres instead of building them. Investors prefer to buy finished premises because of lack of suitable land sites and complicated permitting process, which makes building process twice more expensive than the purchase of finished project. That is why more about 80% of all office centres were developed by domestic companies and then sold to foreign companies, and only 20% of buildings were developed by foreigners.

Given that the demand for retail and office premises exceeds supply greatly we can assume that these fields will remain the most attractive for foreign investors in 2007.

When it comes to retail property, its attractiveness can be illustrated by the fact that in Ukraine a project will be compensated in 5-8 years while in Europe this process may take up to 10-15 years.

Foreign investors, who have already done justice to the attractiveness of Ukrainian real estate market, are expected to enter in 2007 with large investments. For example, a Russian construction company 'Mirax Group' has already planned to build up a big office centre with its own shopping centre and flats as well. Total area of that project is about 200 000 sq m and its cost is more than $ 350 million.

European investors are being active too. On December 12 2006 EBRD Board of Directors decided to invest $ 12, 8 million in 'Novaya Liniya' retail chain. New trade centres will be built in Lvov, Donetsk, Dnepropetrovsk, Simferopol, Borispol and Bucha. Total area of these shops will reach 115 000 sq m. 37, 3% of company's shares will belong to Cantik Enterprises Ltd, 12,7% - to Ukrainian investment company 'Dragon Capital' and 50% will be owned by Scandinavian company 'East Enterprises Ltd.'

When it comes to warehouses and industrial premises, we can say that it is not developed enough that is why it is hard to evaluate its potential. As of January 2006, supply of professional warehouse premises was only about 154 000 sq m, while market capacity was assessed as 0, 85 - 1 million sq m. Class A and B warehouses were in minority of 30% and their total area was 200 000 sq m. Class C and D premises occupied other 70% of all the warehouses in the country.

Demand for high-quality warehouses and logistic services exceeds supply considerably and this situation will not change for at least two years. Kyiv demand for warehouses amounts 1 million sq m, but there are only 600 000 sq m metres available, not to mention their quality.

Rental rates are growing up as well. Presently, the price of one square metre in class A warehouses vary from $15 to 17, and it is expected to grow up further if the supply is still less than demand.

According to experts' evaluations, only 100 000 sq m will be built in Kyiv during the next few years on conditions that all the premises projected will be delivered in due course, new foreign investors will come and Ukrainian developers will revive. As market analysts say, the supply may reach 400 000-500 000 sq m in 2007-2008 but it is still up in the air.

Despite the fact that Ukrainian logistic services are poorly developed as well, experts say it will expand dynamically due to the international operators that planned to enter Ukrainian market in two-three years (Ramstor, Auchan, OBI, Praktiker).

All the sectors of Ukrainian real estate market are attractive for investors due to the fact that the market is developing dynamically, but experts say that it its logistic and warehouses sector that will develop rapidly in 2007.

http://www.kanzas.ua/

|